If you aren't familiar with the new Beneficial Owner Information ("BOI") reporting requirements, now is the time to get familiar.

2024 is year one of a new non-tax filing requirement, and the non-compliance penalties are hefty. Here is our first post on all things BOI from last fall. Since then, the topic has received some clarifying guidance and additional answers to new FAQ from FinCEN. Below are highlights of what should be top of mind for company owners as you approach the 1/2 mark in 2024:

- Time has passed so due dates are closer (or may have passed)!

BOI filings are urgent if you formed a new entity during 2024, and your filing may already be late. This year, filings for new entities are due within 90 calendar days of confirmation that your new entity is formed or registered. For example, if you formed a new entity on January 1, 2024, the filing would have been due on March 31, 2024. If that filing were as yet unfiled, it would be 46 days late (as of this writing).

This should also be top of mind if you are forming new entities at any point in the future. Starting with entities formed next year (2025), the initial BOI filings will be due within 30 days of formation or registration.

For existing entities (pre-2024), filings aren't yet late, but the due date is now less than 8 months away.

- Penalties for late filings or non-compliance are stiff.

In January, the inflation adjusted civil penalty went up to $591 per day for late filing.

Criminal penalties are up to $10,000 and up to 2 years in jail.

FinCEN is serious about compliance!

- The purpose of the FinCEN Identifiers ("FinCEN IDs") and process for obtaining them has been clarified!

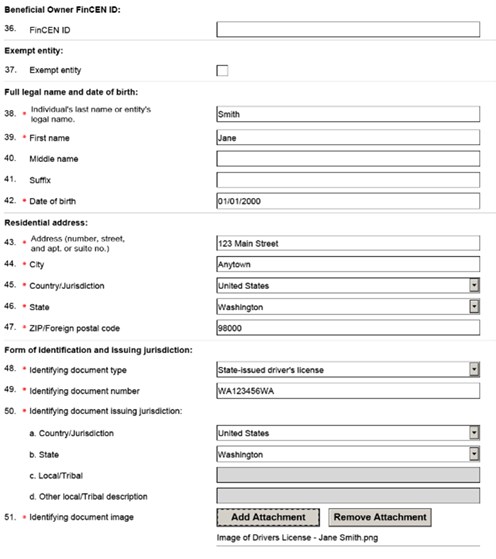

First, some background on FinCEN ID’s. A FinCEN ID is a unique identifying number issued to an individual by FinCEN. To get a FinCEN ID an individual submits the same information they would use to substantiate and report out individual beneficial owner information (licenses or passports, birthdays and addresses). If an individual has a FinCEN ID, the ID number can be reported on any BOI filings where that individual is a beneficial owner instead of providing all of the underlying identifying information and support on each BOI filing. If any information included on either filing (the BOI filing or the FinCEN ID application) changes, the affected filing needs to be updated within 30 days.

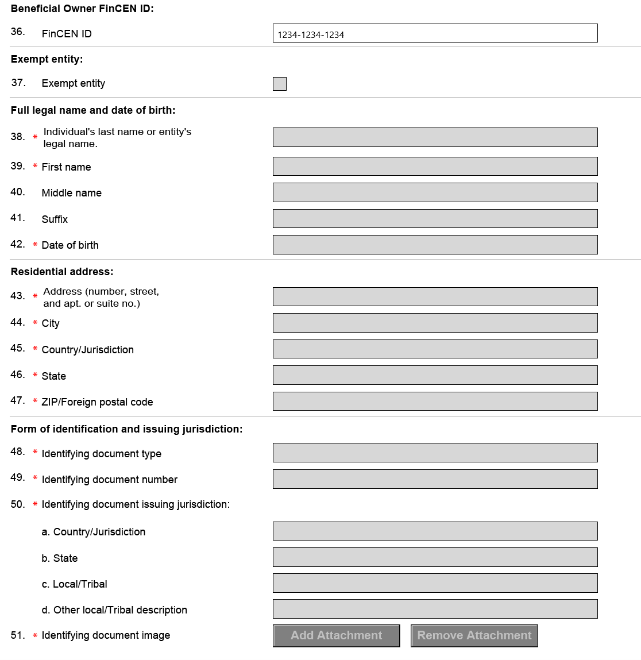

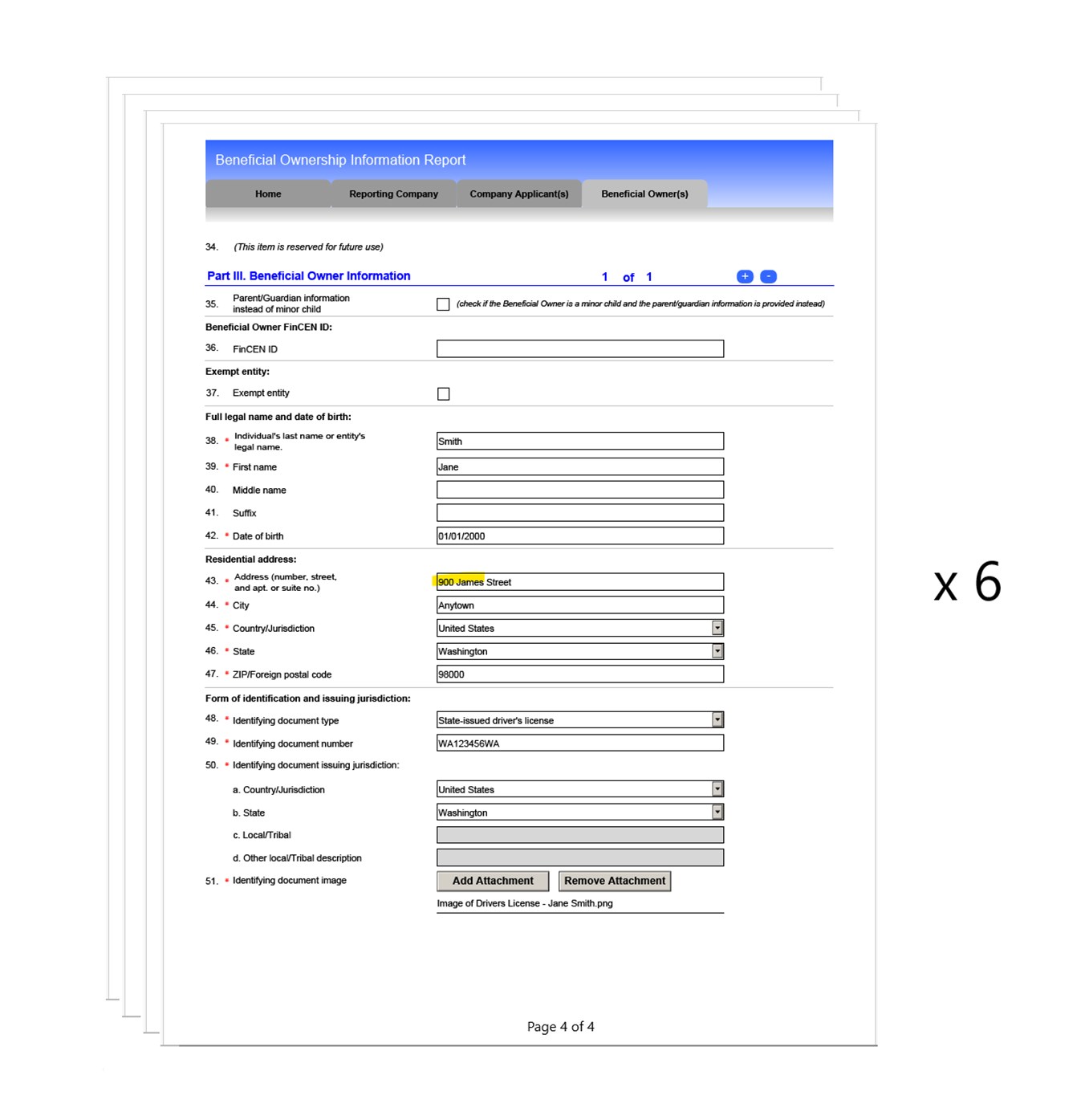

Thus, the benefit of getting a FinCEN ID is to streamline the process of initial reporting and of updating information on file with FinCEN when changes related to a beneficial owner occur if an individual is a beneficial owner for multiple entities. The BOI reporting using a FinCEN ID replaces 13 lines of data and an image of an ID with one 12-digit identifier. With a FinCEN ID, if information on an individual beneficial owner changes, the BOI filing does not need to be updated. Instead, the individual submits an update to their FinCEN ID record once. For example, if an individual who is beneficial owner of 6 entities moves across town, this means they only submit one filing to FinCEN instead of 6.

| For initial filings the BOI application goes from this... |

|

| ...to this |

|

| |

| And for updates related to an owner, the submissions go from this... |

|

| ...to this |

|

- If you haven’t filed, or don’t have a plan, Julien Unger & Associates can help.

These filings are intended to be self-service by businesses and their owners. FinCEN has published user guides in the form of an FAQ and a Small Entity Compliance Guide.

However, if you want assistance with your filings, we’re here to help. Please reach out to Nate or Chris for next steps.